Part 2 - What's in store for 2020?

THE YEAR OF THE EVERYDAY AUSTRALIAN

It was a tale of two markets last year, pre and post-election. Leading up to the

federal election, in May 2019, confidence had been dented by the banking royal

commission and debate around proposed changes to negative gearing

and capital gains tax concessions. These two factors, combined with tighter bank

lending practices, saw buyers pull back from the market and property values

decline. But what happened next surprised us...

Take a look at part 2 of our 3 part series for what's in store for 2020?

TREND # 2

RENTERS BECOME HOMEOWNERS

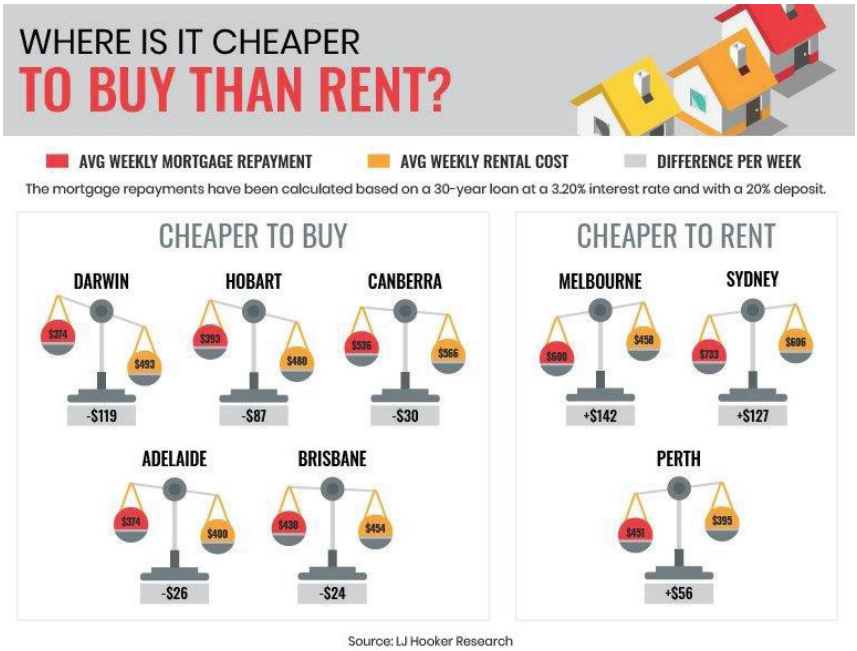

Record low interest rates, APRA softening mortgage serviceability requirements, and property prices below their 2017 peak have made weekly mortgage payments cheaper than weekly rents in most capital cities.

Let's look at the figures.

No matter the area, and even if prices should continue to rise, all indicators are

green to make the leap in 2020, with affordability still quite good compared to

where it was. Renters willing to buy their first home will have everything to gain by

taking action in the coming year, starting with a decrease in their housing costs.

But what if, despite all these favourable signals, they can't afford to buy where they

live? Then two alternatives have seemed to take shape in the past year; either

move to a nearby more affordable suburb, or make a bigger move and relocate to

a regional area, where opportunities to enjoy a similar could be at a much more

affordable cost.